Over the last two weeks we’ve seen the country come to a standstill and the property market effectively put on ice until we are out of lockdown.

The next few months are going to be incredibly difficult for everyone, but it is vital that agents take this time to start planning for the future. Taking the right steps over the next few weeks will be key to ensuring that you’re ready to hit the ground running as soon as some of the current restrictions are lifted.

Unlike after the last recession, current predictions are that the market could recover relatively quickly, but what evidence do we have to support that theory?

Following the General Election in December, pent up demand from people who had been holding back due to Brexit uncertainty, flowed into the marketplace. Could that stand us in good stead for a quick recovery?

Let’s look at the figures…

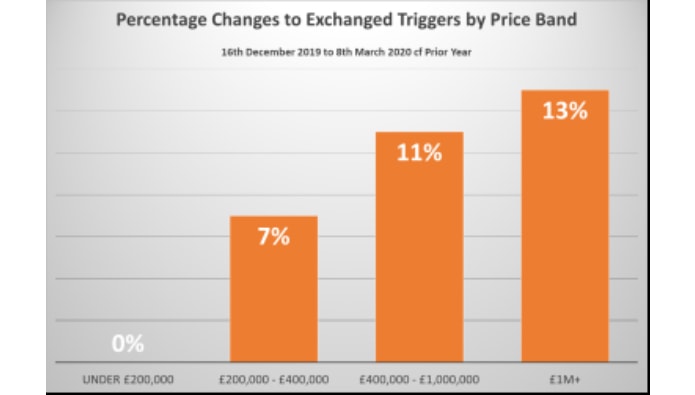

The data – exchanges

Looking at the change in volumes of Exchanged triggers, we can see that the largest increase in exchanged properties came from the £1 million+ price bracket, with property prices from £400,000 to £1 million not far behind.

Both top brackets were experiencing unprecedented double digit growth year-on-year.

In addition, the £200,000 to £400,000 price bracket was also seeing a very healthy growth in exchanges year-on-year.

You could, however, make a strong argument to suggest that a large portion of this effect was not as a result of electoral stability, because it takes so long to complete a property purchase.

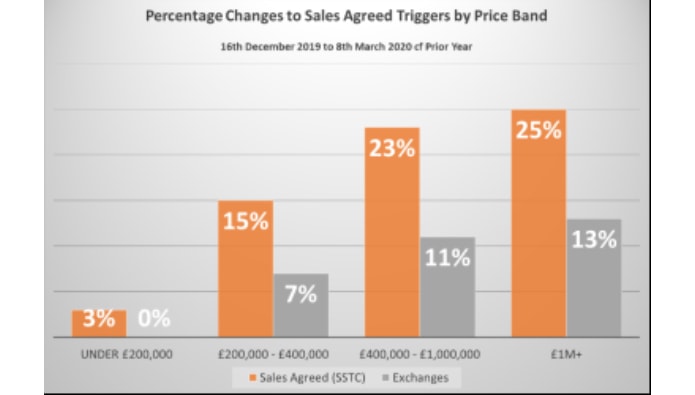

Looking at the volume of changes in sales agreed (or SSTC) would perhaps provide an even better view of what happened in the first few weeks of 2020 compared with the prior year.

The data – sales agreed

This chart adds the Sales Agreed (or SSTC) trigger changes to the Exchanged triggers and it certainly makes interesting reading.

Firstly, we can clearly see that the changes to SSTC volumes were far more dramatic in all price brackets – roughly double the growth in exchanged triggers.

In properties above £400,000, we were seeing north of 23% growth and the £200,000 to £400,000 bracket, a more than healthy 15% growth in sales agreed.

The only slight downside is that the sales agreed growth rate in properties under £200,000 was comparatively very low.

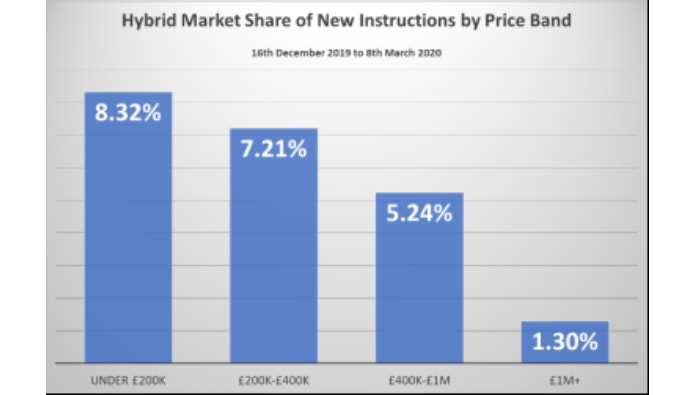

The high street agent effect

Now let’s look at the market share of high street agents versus hybrids (those without a traditional branch network).

The market share of new instructions by price bracket for hybrid agents is shown in this chart.

What we see here is that a hybrid agent’s market share was highest in the poorest price bracket where sales agreed volumes were growing much slower year-on-year than they were in the other three price brackets.

This means that the benefit of the increase in sales seen since the election of 2019 will have been disproportionately felt by the more traditional high street estate agent.

Of the growth in sales that has been experienced to date in the £200,000 to £400,000 selling price bracket, nearly 93% of this will have gone to high street agents.

As we move onto the £400,000 to £1 million selling price bracket, just under 95% of the benefit will have gone to high street agents.

And finally, in the specialised £1 million plus selling price bracket, nearly 99% of the benefit will have flowed through to high street agents!

So what does this mean for the future?

Unfortunately, no-one knows how long lockdown will continue or indeed, exactly what the future of the property market looks like. However, looking at the performance of the market up until mid-March 2020 tells us a few things;

– A high volume of people actively wanted to move

– This was most prevalent for properties in the £200k+ price bracket and even more so at £400k+

– The majority of this activity was taking place with high street agents

Although unfortunately some of these agreed sales will recently have fallen through and many properties will now have been withdrawn from the market, the likelihood is that most of these people will still want to move once they are allowed to.

This should create increased demand on available stock, thereby encouraging more new instructions. The best news is that once these vendors do return to the market, sales should continue to be high value and skewed towards high street agents.

What can you do in the meantime?

It is essential that you maintain contact with those vendors either already on the market, or who have recently withdrawn – both your own and those of your competitors.

Now, more than ever, you must look after your pipeline so that you’re not starting from scratch when the market inevitably picks back up.

This is an opportunity to establish a ‘trusted advisor’ relationship with these vendors, offering them help and guidance when their future move now seems uncertain.

At times like these how you treat your customers and potential customers is paramount. They will need far more hand-holding and direct communication. Some agents are not going to do this and, as such, we are likely to see even more agent switching once we are out of lockdown as vendors become frustrated with a lack of support from their existing agent.

It is vital, though, that what you’re sending is sensitive to the current situation and you don’t just continue to send the same message as you would have done a few weeks or even days ago.

Now that you’re not spending your time on the usual day-to-day tasks use it as an opportunity to really work on the content of your communications and make sure the messages you send highlight the changing requirements of the current marketplace.

Talk about the services you offer that can help vendors restart their property sale as quickly as possible once we’re out of lockdown; share your plans on;

– Virtual tours

– Accompanied remote viewings

– Floor plans

– Live streaming of ‘virtual open houses’

– Online auctions

– ‘Little Black Books’ promoting ‘the best kept secrets’ or houses not openly marketed and see if sellers want to be on it